Heat Pump Tax Credits 2024. December 6, 2023 by namma tech. What is the energy efficient home improvement credit?

The process for claiming your geothermal heat pump tax credit is straightforward and impactful. At the federal level, consumers are eligible for a tax credit that covers 30% of the cost of buying and installing a heat pump, up to a maximum of.

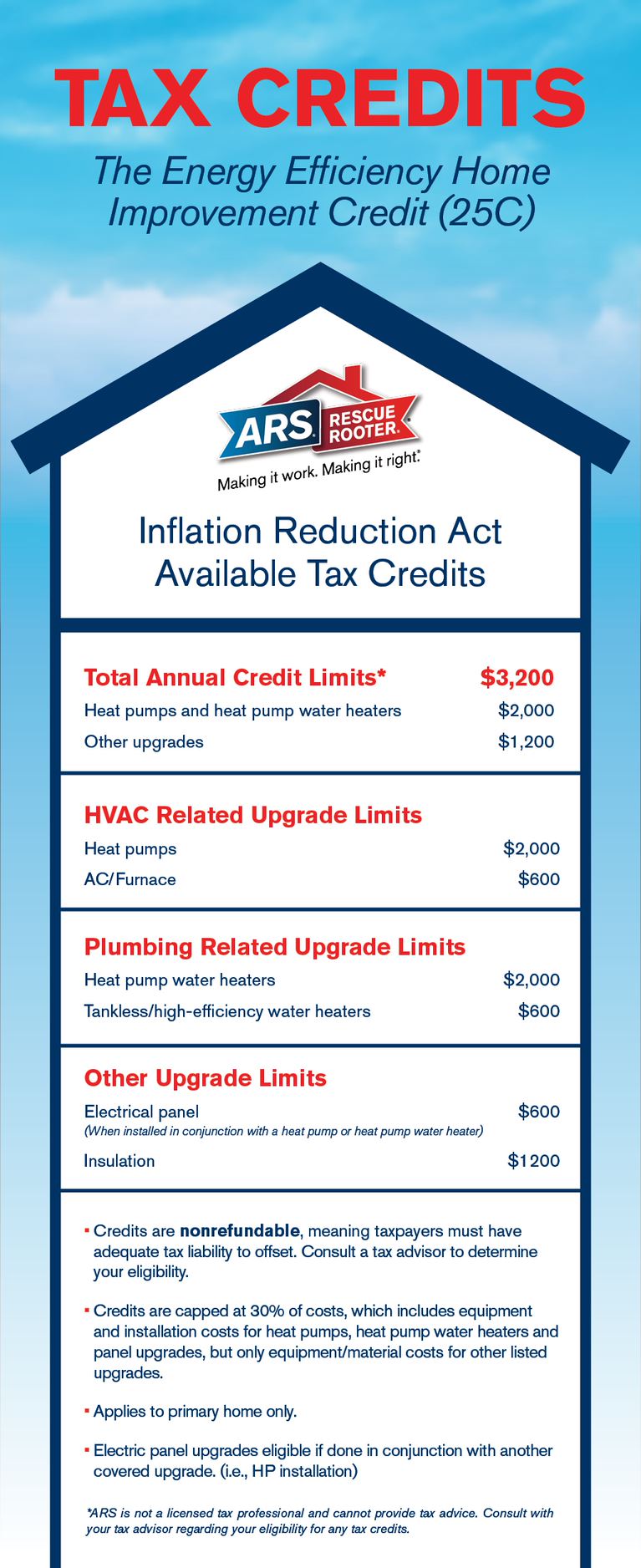

You Can Receive Up To $3,200 In Federal Tax Credits For Installing Qualifying Hvac Equipment Into An Existing Home, Split Between Acs, Furnaces, Or Boilers ($1,200).

Taxpayers who invest in and install a qualifying heat pump in their primary residence can take.

Hvac System Heat Pump Tax Credits.

The inflation reduction act heat pump tax credit is worth 30% of your.

Larger Federally Funded Rebates Might Become Available In 2024, Though They May Not Be.

Images References :

Source: www.symbiontairconditioning.com

Source: www.symbiontairconditioning.com

300 Federal Tax Credits for Air Conditioners and Heat Pumps [2022, To be eligible for the heat pump tax credit in 2024, homeowners must meet certain criteria. December 6, 2023 by namma tech.

![30 Federal Tax Credits for Heat Pump Water Heaters [2023]](https://www.raysplumbinginc.com/wp-content/uploads/tax-credits-2023-social.png) Source: www.raysplumbinginc.com

Source: www.raysplumbinginc.com

30 Federal Tax Credits for Heat Pump Water Heaters [2023], How to make the most of energy efficiency tax credits in 2024. For example, if your heat pump is deployed in 2023, you can redeem your credit when you submit your taxes in.

Source: moneywise.com

Source: moneywise.com

Heat Pump Tax Credits and Rebates Continue in 2024 Moneywise, It’s been in place for many years but was recently revamped by the inflation reduction act. Government, such as those with a minimum seasonal energy efficiency ratio (seer) and heating seasonal.

Source: airconditioningarizona.com

Source: airconditioningarizona.com

Heat Pump Tax Credit Magic Touch Mechanical, American standard’s accucomfort platinum 20 heat pump can save you thousands in tax credits and rebates in addition to lowering your home’s energy bill. A provision increases the refundable portion of the additional child tax credit (now capped at $1,600 per child) to $1,800 per child in 2023, $1,900 per child in 2024,.

Source: www.youtube.com

Source: www.youtube.com

Tax credits offered for heat pump installation YouTube, Heat pumps that meet the energy efficiency criteria set by the u.s. 30% of your project costs, up to $2,000, with an additional $600 tax credit for.

Source: www.revisionenergy.com

Source: www.revisionenergy.com

2023 Residential Clean Energy Credit Guide ReVision Energy, Homeowners are required to use form 5695, the. The calculator says the smiths will qualify for rebates in 2024, and they qualify for $15,600 in available tax credits right away, which means they can claim those tax credits on their 2023 taxes.

Source: www.symbiontairconditioning.com

Source: www.symbiontairconditioning.com

300 Federal Tax Credits for Air Conditioners and Heat Pumps [2022, December 6, 2023 by namma tech. Heat pumps and heat pump water heaters.

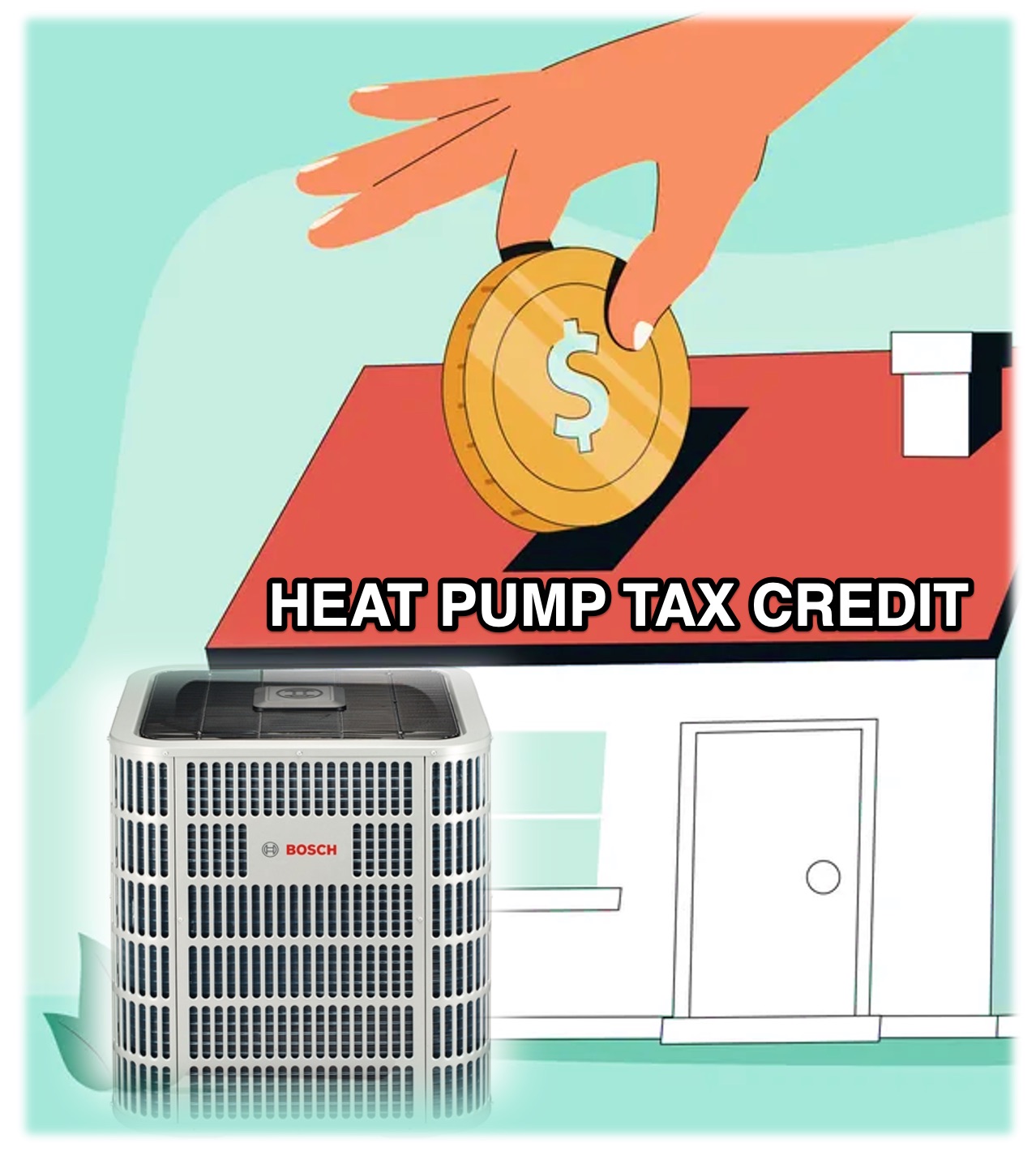

Source: www.ars.com

Source: www.ars.com

HVAC & Heat Pump Tax Credits 2023 Efficient Home Improvements ARS, The heat pump tax credit is available to install the following types of heat pumps or other technology: A provision increases the refundable portion of the additional child tax credit (now capped at $1,600 per child) to $1,800 per child in 2023, $1,900 per child in 2024,.

Source: www.forbes.com

Source: www.forbes.com

Heat Pump Tax Credit 2024 Forbes Home, The process for claiming your geothermal heat pump tax credit is straightforward and impactful. The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022.

Source: www.rescueairtx.com

Source: www.rescueairtx.com

What You Need to Know About the Federal Tax Credit for Heat Pumps in 2023, The energy efficient home improvement credit can help homeowners cover costs related to qualifying. You can receive up to $3,200 in federal tax credits for installing qualifying hvac equipment into an existing home, split between acs, furnaces, or boilers ($1,200).

How To Make The Most Of Energy Efficiency Tax Credits In 2024.

Firstly, the heat pump must be installed in the taxpayer’s primary residence.

The Energy Efficient Home Improvement Credit Can Help Homeowners Cover Costs Related To Qualifying.

At the federal level, consumers are eligible for a tax credit that covers 30% of the cost of buying and installing a heat pump, up to a maximum of.